Microfinance boosts latrine purchases in rural Cambodia

An innovative way to integrate micro-finance and sanitation marketing is resulting in a truly Hands-Off success story and helping to scale up access to safe toilets by the rural poor.

Many proponents of market-based sanitation programs around the world are keen to explore financing as a way to make toilets more accessible to the rural poor. The most repeated complaint by rural villagers when discussing toilet adoption in Cambodia, like elsewhere, is aut louy or “no money”.

Cost is also one of the major roadblocks in offering sanitation financing: loan assessment, disbursement, and payment collections are expensive activities. Because loans for toilets are relatively small, the interest (even at high rates) is not likely to offset the operating costs of the micro-finance institution (MFI). Furthermore, MFIs typically prefer to offer ‘productive’ loans as a opposed to ‘consumptive’ ones because of their lower risk of delinquency or default (a loan to buy a sewing machine for a small business that will generate revenue to make payments as opposed to a loan to repair the roof of a house). Loans to purchase toilets and water filters are considered consumptive.

Due to the high cost of operations and the perceived risk of consumptive loans, MFIs have often used donors funds to subsidize loans for socially good products and services such as lighting products, bio-digesters, water & sanitation, cookstoves, etc. This approach can generate additional product uptake but its main risk is the lack of sustainability. Economist Jonathan Morduch called the split between “sustainability” and “poverty” advocates the “microfinance schism”, and David Roodman questioned the advantages and disadvantages of building subsidy into microfinance, asking, “How are we to weigh cheaper services for a smaller group against more expensive services to a larger group?”

In Financing Microfinance for Poverty Reduction, Gibbons and Meehan wrote,

Even when MFIs become profitable, accumulated profits will not support the kind of large-scale growth required to reach large numbers. Until now, many MFIs have utilized grants from donors to support their operations both in the early years and as they scale up. Yet such grants, already limited in size and availability, are becoming harder to come by as the pool of global MFIs grows… We must start thinking more innovatively – as most commercial businesses do – about our financing strategies.

WASH Loans

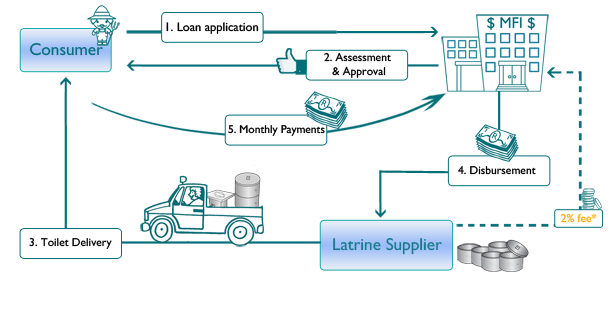

In January 2013, WaterSHED introduced a new model of WASH Loans in partnership with the MFI VisionFund. Instead of subsidizing the MFI, WaterSHED encouraged VisionFund to charge a loan origination fee in the form of an interchange fee. The fee is similar to the interchange fee paid by merchants around the world who accept payment cards such as VISA or Mastercard, and is typically around 2 percent of the purchase price. Also following the payment card model, VisionFund pays the toilet seller directly instead of disbursing the loan to the consumer.

WASH Loan process. *The interchange fee is deducted from the disbursement automatically.

Results

In 9 months more than 1,237 loans have been approved and disbursed to 29 participating toilet suppliers who, in turn, delivered new latrines to customers. The uptake is continuing to accelerate.

From the customer’s perspective, being able to make payments over time instead of in one lump sum can mean the difference of adopting a latrine or continuing open defecation.

From the merchant’s perspective, paying the MFI roughly 2 percent of the retail cost of the toilet (automatically deducted by the MFI from the disbursement) in order to sell many more is well worth it. There is also an additional advantage in that collections are made much simpler and cheaper for the toilet supplier – they are transferred directly by the MFI.

Phea Praser, a toilet producer in Ek Phnom district in Battambang province said the loan scheme had smoothed his otherwise lumpy income stream. “The loans have not only increased my sales orders, but also eased the pressure and difficulty I used to have in collecting the money,” he said, “I can get full payment immediately from VisionFund after delivering the product, so that I don’t have to go from door to door to ask for repayment.”

VisionFund is keen to expand the sales program using the concept of interchange fees. The fees represent a new revenue stream that can enable greater and faster expansion of MFI financial product offerings, while at the same time making MFIs more accountable to their customers (i.e. suppliers and consumers) – rather than to donors.

WaterSHED’s Hands-Off philosophy leads it to promote solutions that minimize the role of outside donors and NGOs with the dual goals of increased sustainability and replicability. Since January 2011 the Hands-Off sanitation marketing project has enabled the sale of more than 55,000 toilets to rural consumers by roughly 160 partner local enterprises. The program has also been a vehicle for hygiene and sanitation messages to more than 125,000 villagers who have participated in group sales events.

WASH Loans, the integration of micro-finance with WaterSHED’s WASH marketing program, supports the strategy of increasing market penetration of essential products such as safe latrines by lowering the barriers to purchase.

The sanitation finance program is based on initial testing between October 2011 and December 2012 in which WaterSHED substantiated the demand for consumer finance by having loan officers present during sanitation group sales events. During that study period, 27.4% of the total participants applied for a loan for a latrine or indicated their intent to apply for one in the future.

As an MFI on the forefront of positive change, VisionFund works with a range of partners to improve its offerings. WaterSHED entered a collaborative partnership with VisionFund Cambodia in mid-2012 to disburse sanitation loans to enable the rural poor to buy latrines in selected areas. It began in Battambang and Pailin provinces, and in mid-2013 was expanded to include Takeo province. Phav Daroath, WaterSHED’s WASH Marketing Manager, said the loan is a catalyst to increase latrine purchases. “We are working hard to make the program available in all seven provinces in which Hands-Off sanitation marketing is currently covering.”